News & Trends

Which DAX companies pose the greatest climate risks

According to Morningstar, around 50 billion euros are invested in equity funds and ETFs with a focus on German blue chips at the beginning of October 2021. It can be assumed that a large part of this money comes from German investors. This is known as the home bias. Investors like to buy what they know. But are investors aware of the climate risks they are taking? For Globalance, climate risks are also investment risks.

In this white paper, we discuss methodological options for identifying, evaluating and classifying these climate risks in investment portfolios. The individual listed companies in the DAX40 serve as a basis, on the basis of which we show absolute greenhouse gas values in production and consumption values in the product cycle. These CO2 equivalents in relation to turnover indicate the carbon intensity of business models. Based on this data, Globalance creates a global warming potential, which puts economic activity in the context of the UN climate targets of 2 degrees Celsius warming compared to pre-industrial times.

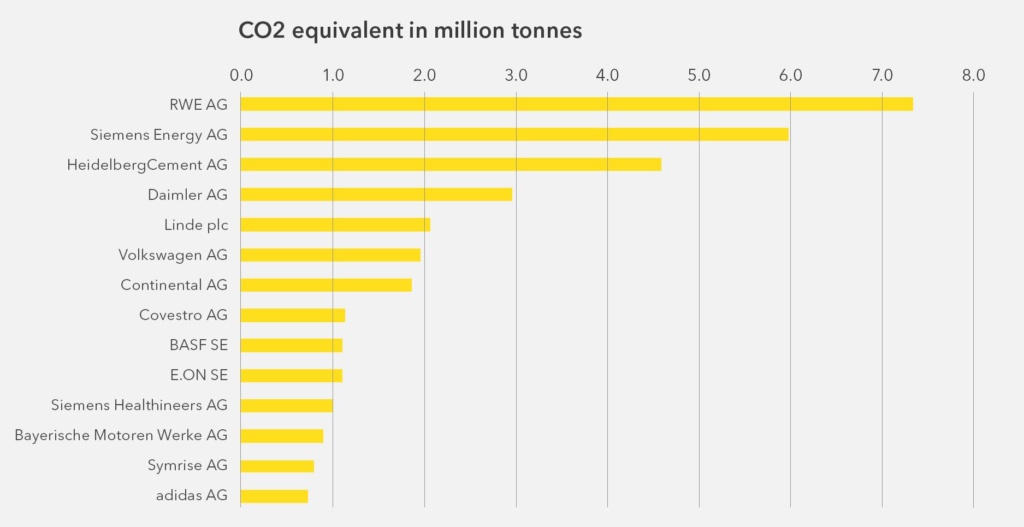

Who emits the most carbon in Germany in absolute terms

The evaluation shows which German DAX companies emit the most CO2 equivalents in absolute terms. Or in other words: how much carbon is released by the economic activity of companies today.

The business activities of car manufacturers and suppliers Porsche, Daimler, Continental, Volkswagen and BMW have, as expected, a high level of greenhouse gases, which are produced during production, preliminary products such as steel and the life cycle of combustion engines that are still predominantly sold. HGVs, cars and buses with conventional engines emit exhaust gases over their operating life.

In addition to wind turbines and alternative energy technologies, Siemens Energie still has substantial business interests in coal and gas-fired power plants. Firing up with fossil fuels releases CO2. At the utility RWE, the production of electricity from coal and gas produces substantial emissions. The same applies to the building materials group HeidelbergCement: The cement plants are mainly operated with conventional energy, and CO2 is also released in a chemical process when clinker is converted into cement.

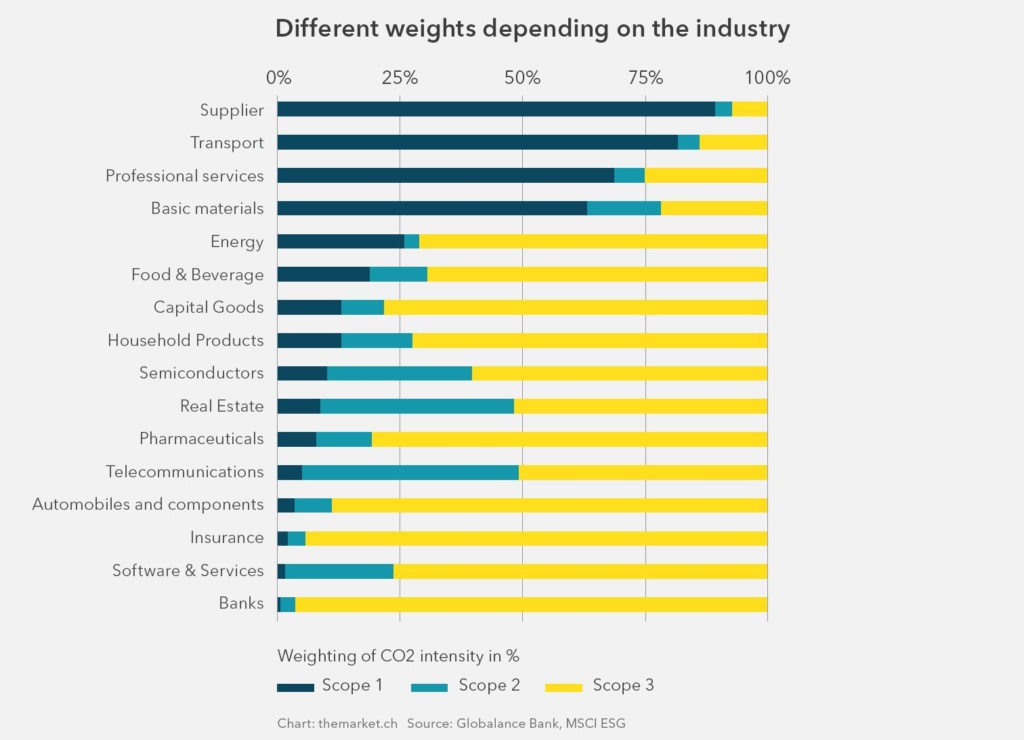

Economic activity of companies can be divided into the production and life cycle of products and services in the modelling. International standards distinguish with Scope 1 and 2 the CO2 released during production. Scope 3 models the carbon footprint over the life cycle of a product and the CO2 footprint of the processed primary products, such as the steel in a car. In this context, we also speak of direct (Scope 1 and 2) and indirect (Scope 3) greenhouse gas emissions.

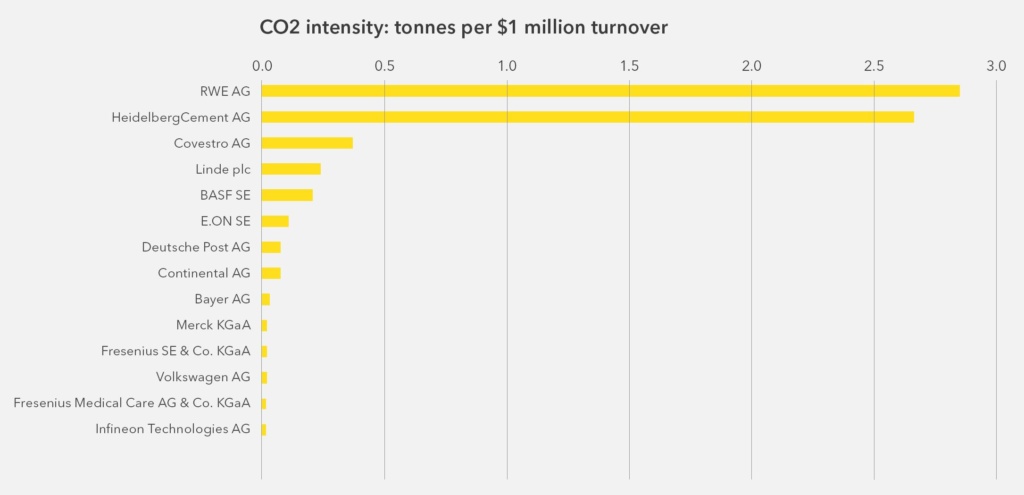

Who releases the most climate gases during production

In the chemical industry (Covestro, Linde, BASF), many fossil fuels are used in production. RWE’s energy mix still has a significant share of gas and coal power, which releases large amounts of CO2. The production of cement also makes considerable use of conventional energy.

Which companies with life cycle products and pre-products have a high carbon footprint

Siemens Energy’s product mix consists of conventional plants such as gas or coal-fired power plants, the production of alternative energy sources such as wind turbines through its subsidiary Siemens Gamesa, and technical services for industry for decarbonisation. The high value in tonnes of CO2 equivalents is due to the CO2 footprint caused by the technologies of conventional power generation plants.

The greenhouse emissions of car manufacturers are based on the product footprint of car fleets that are still predominantly based on combustion engines.

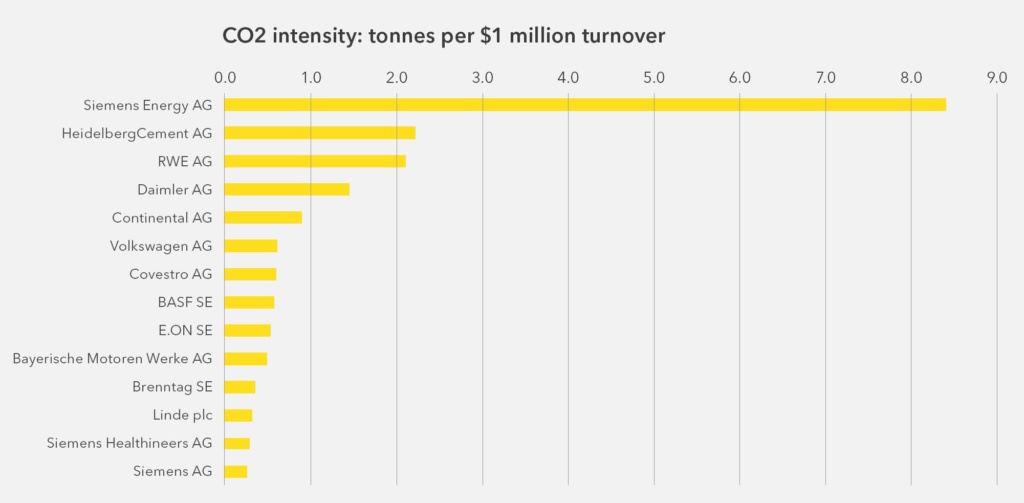

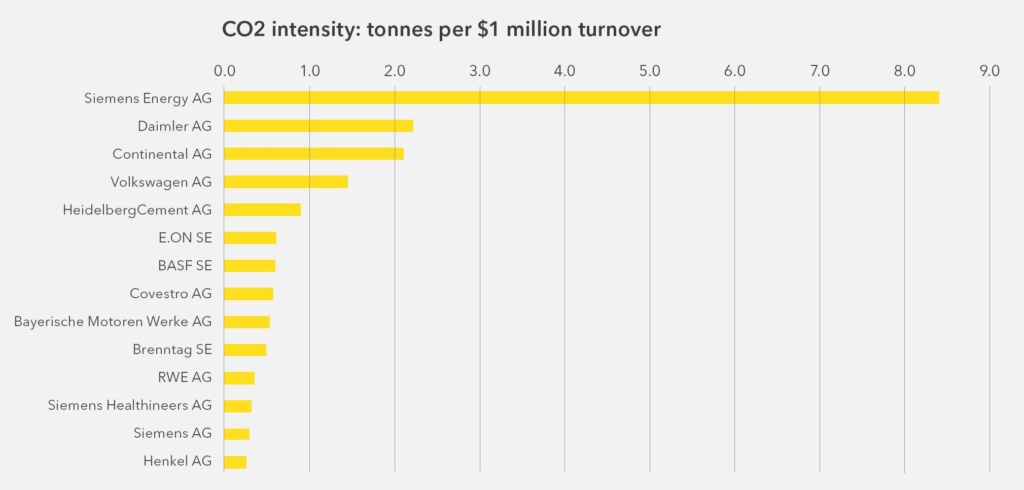

From absolute CO2 emissions to a measure of carbon intensity

The absolute measure of CO2 emissions is largely determined by the size of a company. If one compares the emissions with the turnover of a company, investors receive the carbon intensity: which companies emit the most greenhouse gases per million dollars of turnover:

The industry-heavy DAX is primarily characterised by carbonintensive production in the utilities, automotive and chemicals sectors. Together, the sectors are weighted at 21% in the DAX.

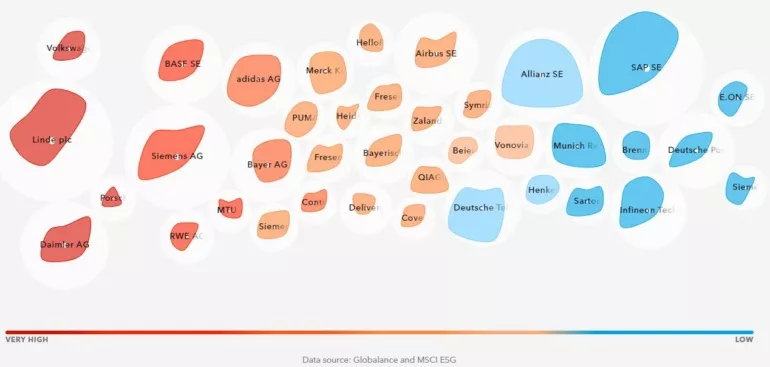

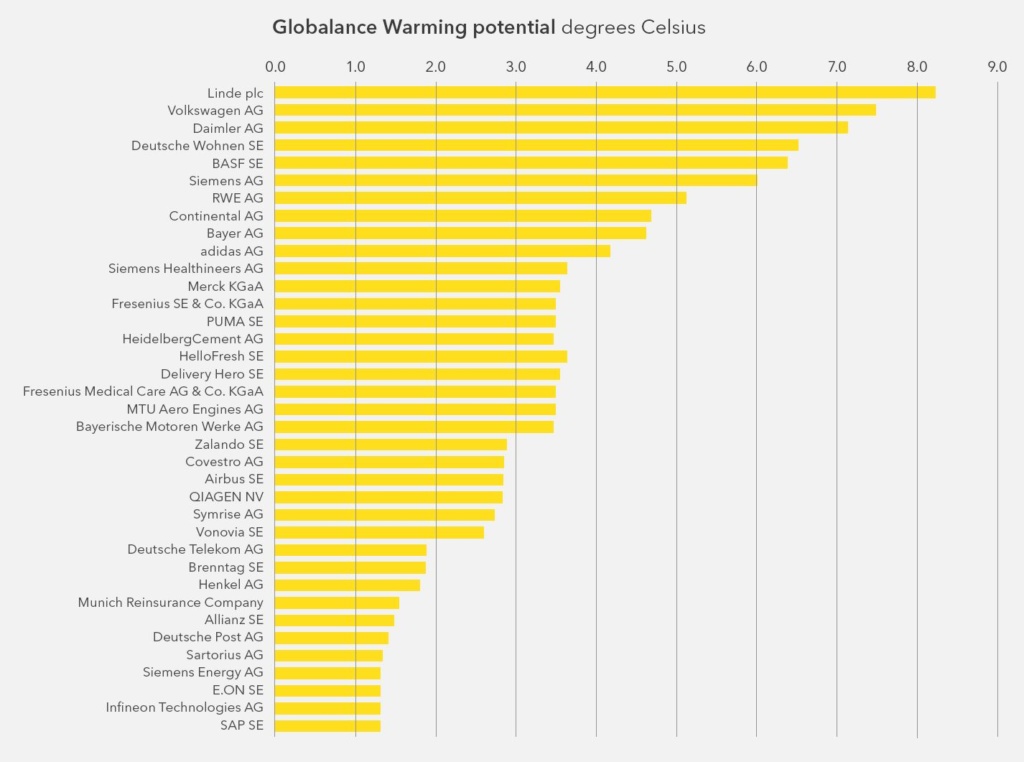

The influence of companies on the global 2 degree climate target

Globalance has been working for many years with Zurich-based Carbon Delta, which was acquired by data provider MSCI in 2019, to assess and rank companies in terms of their emissions activity and impact on the UN climate goals. Its climate model relates a company’s CO2 emissions to its individual contribution to the global climate. The model incorporates sector classifications with corresponding weightings of direct and indirect emissions activity (Scope 1,2,3), sales data, CO2 intensity data and business activity. Based on these data sets, climate curves are simulated that represent the respective warming potential of a company.

The model thus takes into account the different characteristics of different industries. Conventional utilities with coal and natural gas power generation are granted higher CO2 budgets than, for example, software producers who only need the electricity to run the data centres.

Self-set and bindingly communicated reduction targets of the companies are included in the models. Relevant patents on the technological progress of products and services that lead directly to CO2 savings are also included. These are represented in the model via the factor “Cooling Potential”. However, Globalance Impact Research assesses the “cooling potential” more cautiously than MSCI in the aviation, chemical and cement sectors. The contribution of microelectronics and semiconductors, on the other hand, are attributed a higher “cooling potential” than MSCI. Globalance also works with more than 650 different sectors and sub-themes, which leads to a higher granularity than MSCI.

DAX Warming potential is 4 degrees Celsius

Compared to a long-term 2 degree climate stabilisation scenario, the DAX40 has a climate warming potential of 4 degrees Celsius. This temperature value indicates the level of climate change to which the current activities of the individual emitters are directed. For the calculation, the temperature values of the individual investments are capital-weighted and added together: BASF has weight in the DAX of 4.2% and a warming potential of 6.4 degrees Celsius, Infineon is represented in the DAX with 3.4% and has a warming potential of 1.3 degrees Celsius.

Globalance World

Investors can find out about around 6,000 shares and funds in Globalance World and their global warming potential. Globalance World is a digital globe for investors, who can use it to assess the future viability and sustainability of their investments. Globalance World uses interactive infographics to help investors better understand the complexities of investing and its impact. This kind of “Google Earth” for investors shows how sustainable and future-proof financial investments are. Globalance World is freely accessible and enables investors to get a transparent picture of the impact of their investments.