News & Trends

Uncertainty on the stock markets continues – our assessment.

Summary

- Yesterday, 10-year interest rates in the USA rose above the 3% mark, causing the US stock markets to close with the biggest single-day loss in the past two years. The broad S&P 500 fell by 3.6%, and the technology index Nasdaq 100 by a full 5%.

- Volatility, an indicator of investor nervousness, still has the stock markets firmly in its grip.

- There is also uncertainty about how the war in Ukraine will progress, the impact of China’s drastic zero-COVID policy or the consequences of the central banks’ monetary policy reversal.

- In times like these, it is especially important not to lose sight of the big picture. Despite a dampening of economic growth expectations, these remain at solid, positive levels.

- The Q1 2022 earnings season has started well so far and companies have exceeded their earnings expectations by 80%. However, many are still sticking to their rather cautious outlook for the whole year.

- Some positive momentum might be injected into the second half of the year, supported by the pent-up urge to consume, the easing of supply chains and a gradual decline in inflation.

- Currently, our portfolios are positioned with a neutral to slightly underweighted equity exposure. We only make highest quality investments, ensure broad diversification and hold a significant position in gold. We avoid interest rate-sensitive investments and move into low-correlated investments that withstand market fluctuations as best as possible.

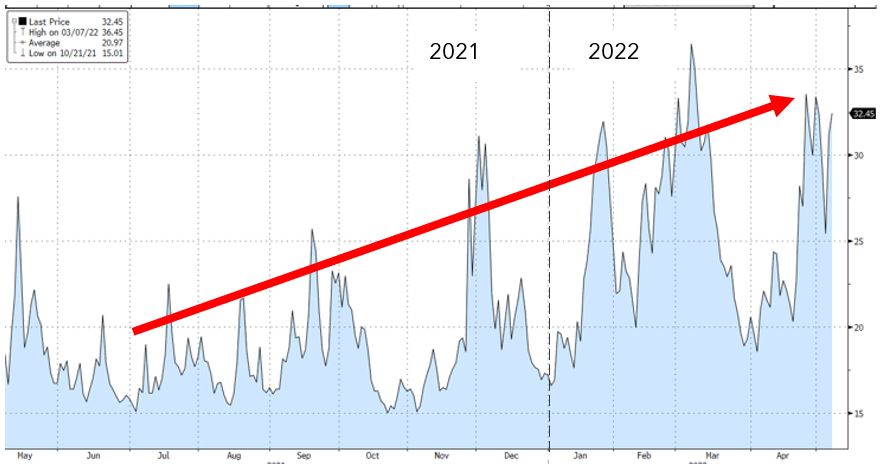

High volatility on the stock markets

Initially it was stubbornly rising inflation, then high energy and oil prices, followed by the outbreak of war and most recently a return to COVID lockdowns in China. The series of negative reports weighed on investor sentiment and caused the volatility index (VIX) to rise again over the last few months to a high of 33. The VIX is thus twice as high as its long-term average.

Significant increase in volatility on the stock markets (S&P 500)

Source: Bloomberg

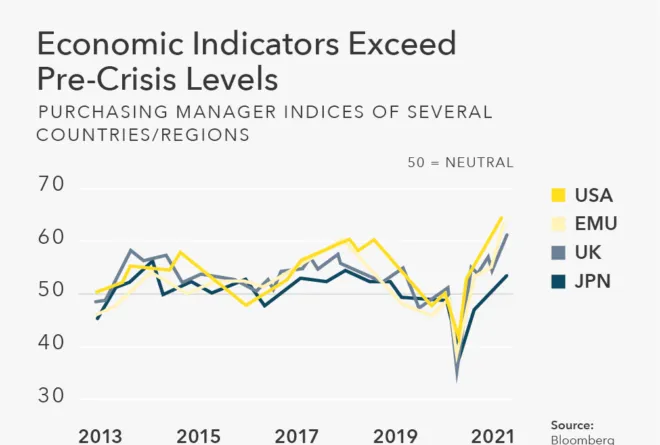

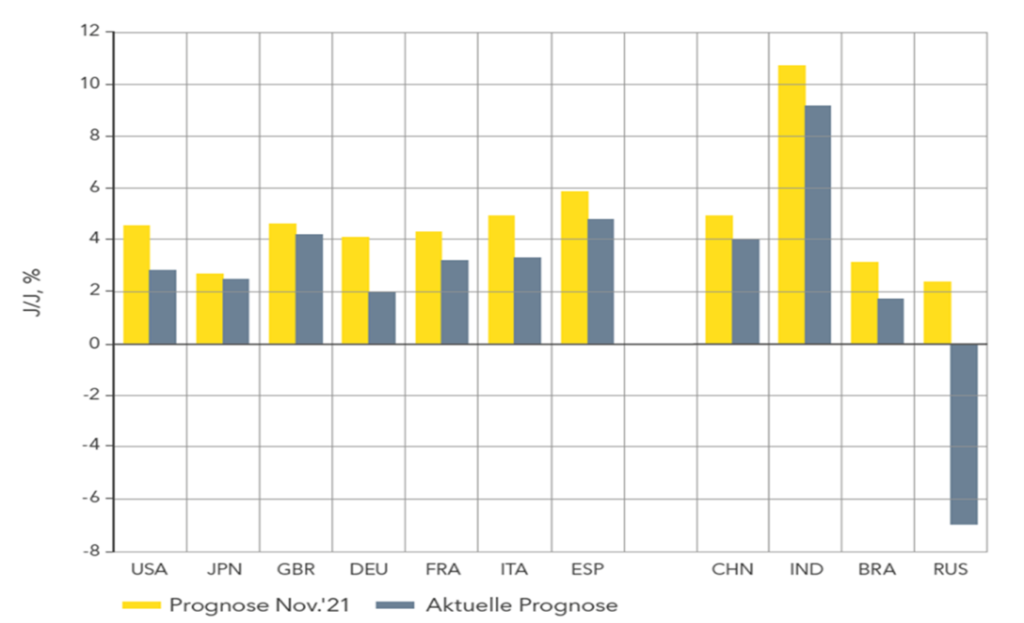

Growth expectations positive despite economic slowdown

The developments mentioned earlier have not left the global economy unscathed. The following chart shows the expected economic growth in 2022 in various regions. The bars illustrate the November 2021 forecast (yellow) compared to the current assessment (grey). Despite the downgrade, growth rates remain at solid, positive levels, with the exception of Russia.

2022 growth forecasts (gross domestic product, GDP) for various regions

Source: Feri Trust; Current forecast from March 2022

Support from solid corporate results

The current earnings season has been positive so far. More than half of the companies have already presented their quarterly figures. In terms of revenue, 72% of the companies exceeded expectations, and in terms of profits the figure was as high as 80%. Technology companies such as Microsoft and Apple, which have recently come under pressure, also shone with record profits.

Remaining uncertainties

At the same time, companies are cautious about their outlook for 2022 as a whole due to the Russian war and globally disrupted supply chains. Increased energy costs, shortages of commodities and strict coronavirus lockdowns in China are keeping inflationary pressures high. This is putting central banks under pressure to scale back their expansionary monetary policy, initiate interest rate hikes and reduce balance sheets.

We expect the situation to ease in the second half of the year. This should enable inflation to start to gradually sink and the supply chains to pick up again as the pandemic is overcome. In addition, the release of the pent-up urge to consume due to COVID should further support economic growth.

Our current positioning

At the beginning of December 2021, and thus before the outbreak of war at the end of February 2022, we had reduced the equity exposure in the asset management mandates and aligned them to a neutral level. We will maintain this neutral positioning for the time being, and advise our clients against larger sale-offs.

Our high-quality core equities have stable business models and comparatively high pricing power. This makes them resilient against inflation in the medium term.

In general, we are ensuring broad diversification across asset classes, regions, sectors and currencies when putting together our portfolios. In real assets, we are holding a significant position in gold as protection against further crisis scenarios. We are reducing interest-sensitive investments such as bonds to the bare minimum and ensuring the shortest possible maturities. We have an overweight in low-correlated investments such as premium strategies, insurance-linked securities and microfinance. These are characterised by minimal interest rate sensitivity and stabilise our portfolios in volatile times.

With these measures, our portfolios are robustly positioned to best withstand the fluctuations as well as to benefit from a possible easing of the situation.

We will keep you informed about further developments and please do not hesitate to contact us if you have any further questions.