News & Trends

Green Bonds – an Investment Opportunity?

Greener, Higher Yield or Both?

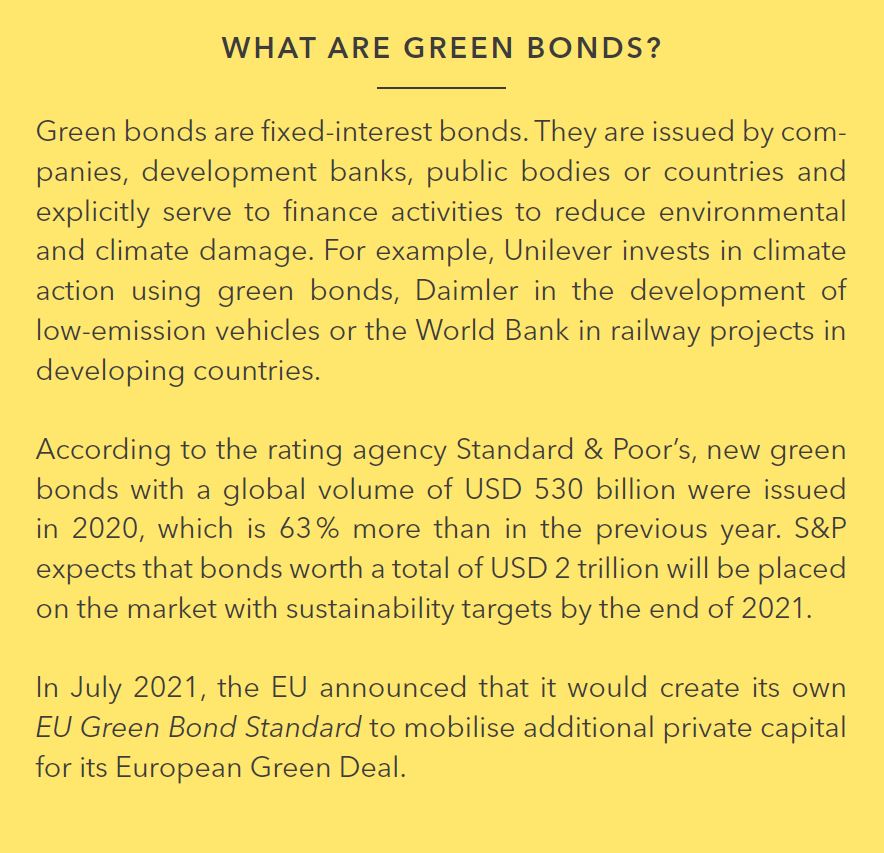

In the search for sustainable investments with a positive impact, green bonds are proving to be high flyers when it comes to climate and environmental issues. This gives investors the opportunity to invest purposefully in appropriate projects. But how transparent and sustainable are the green investments really? We take a closer look and clarify what you need to know about green bonds.

The Swiss telecom provider Swisscom is replacing its diesel vehicles with electric cars and installing solar panels. Measures to help reducing the net CO2 emissions by 450,000 tonnes by 2025. Investors can support the project by investing in Swisscom’s new green bond, which was placed in May 2020 with a volume of EUR 500 million.

Swisscom consequently obtains an interest-rate advantage and substantiates its climate strategy. Investors, for their part, receive proof that their capital is being used directly for environmental improvements. This Swiss example illustrates the worldwide boom of this still young asset class. Growth of over 60 percent was registered worldwide last year alone.

What are the Arguments in Favour of Green Bonds?

The financial sector is seen as a crucial lever to achieve the global environmental targets and to manage the necessary transformations in sectors such as transport, energy or telecommunications. Green bonds have turned out to be a “best seller”. Investors can make a concrete positive impact through them. Important requirement: more tangible evidence that the capital invested is making a positive difference in the world. As for any fixed income investment, a balanced risk and return profile is crucial at the same time. A positive impact, without sacrificing liquidity and return — that’s the selling point.

During their bonds’ term, investors receive evidence of the environmental targets achieved or missed.

Do Green Bonds deliver what they promise?

The criticism of greenwashing has accompanied green bonds since their inception. In the meantime, a sophisticated “ecosystem” of rules and stakeholders has emerged that significantly reduces the risk of abuse. Firstly, quality standards are applied and secondly, issuers have their bonds reviewed by specialised rating agencies. During the term, investors receive evidence of the environmental targets achieved or missed. In addition, the growth of this segment of the capital market has prompted political intervention, which will make environmental criteria even more binding.

How to invest successfully in Green Bonds?

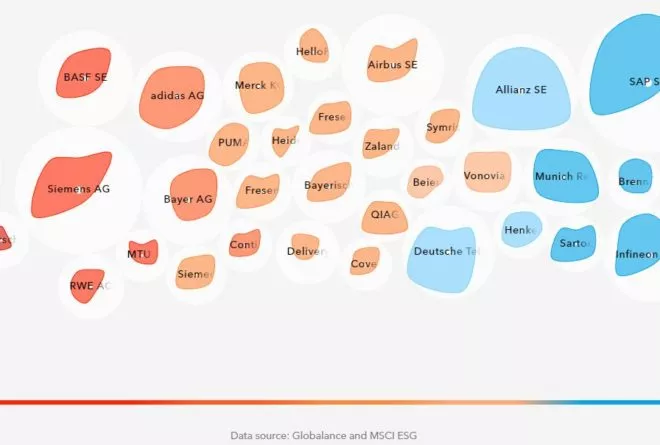

1. Informed, careful selection

Investors need to be more selective, especially in such a fast-growing market, and only invest where the financial fundamentals and positive impacts are a good fit for them. The portfolio should be sufficiently diversified.

2. Check use of capital at project level

Do the planned activities meet the requirements relevant to their intended environmental objectives? This analysis should be quantified by the issuer, if possible, and reflected in the legal documentation for the bond.

3. Check the bond issuer

If the use of capital is assessed positively, the issuer must then be comprehensively assessed in terms of corporate governance and sustainability.

4. Dialogue throughout the term

An ongoing dialogue with the issuers is indispensable to assess the environmental improvements actually achieved.

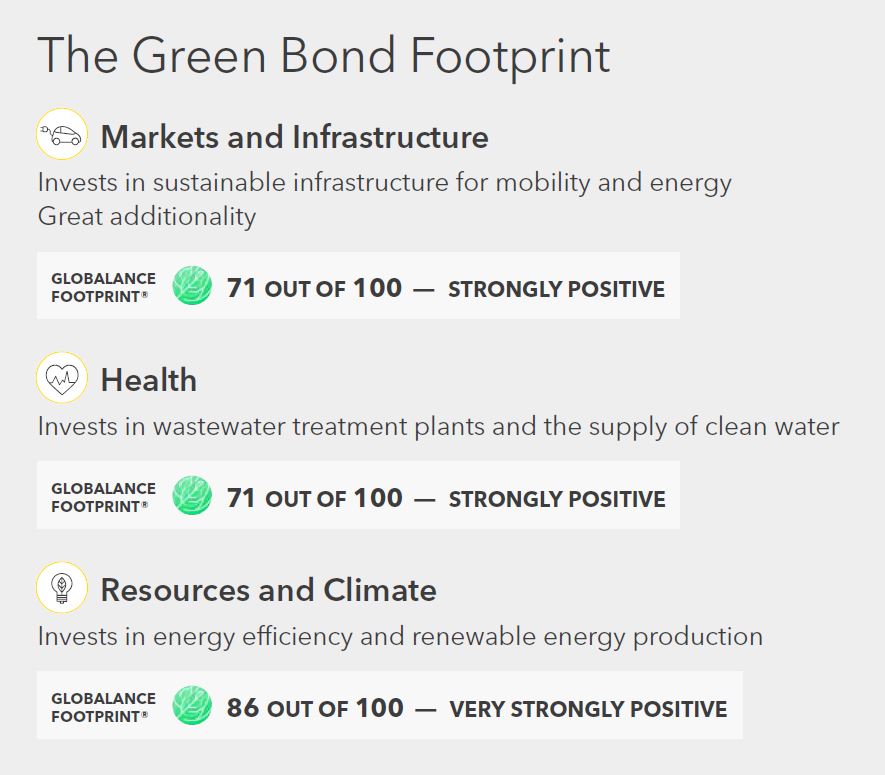

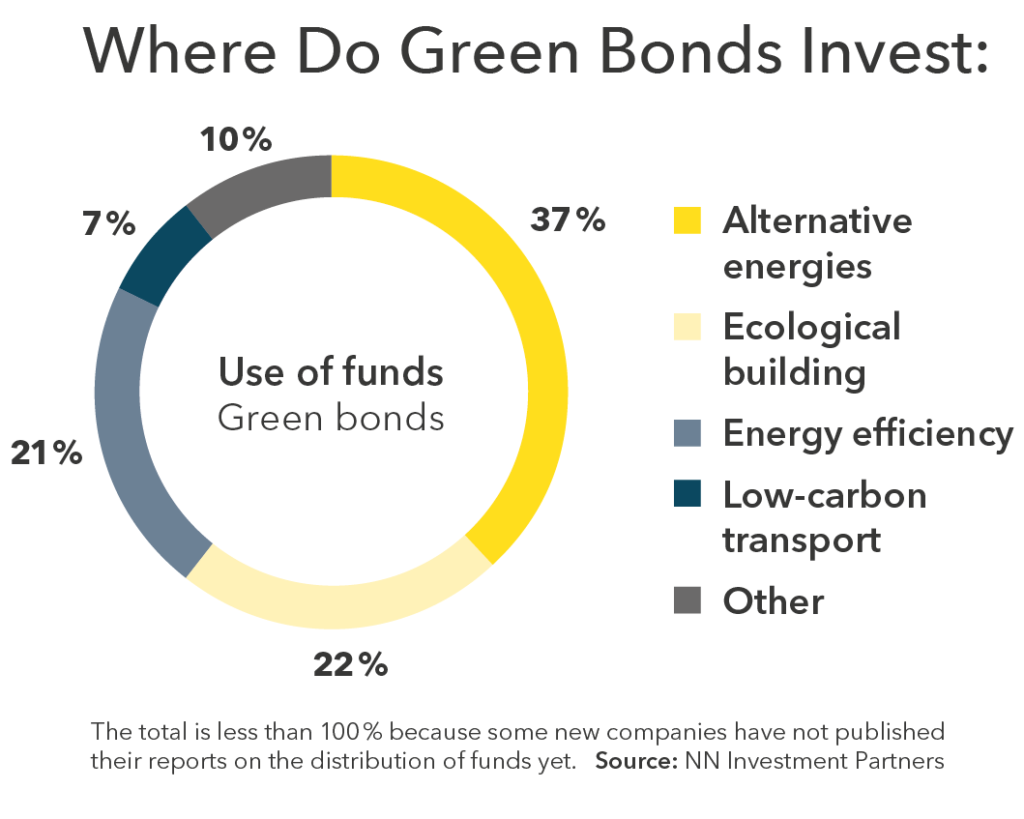

How Globalance invests in Green Bonds

Globalance arbGlobalance works with selected, specialised managers for investments in green bonds. They are in regular contact with the bond issuers. One of these partners is NN Investment Partners, which manages various green bond funds. They provide us with access to detailed reporting on the positive impact of these investments. For example, the annual avoided greenhouse gas emissions are the most commonly reported performance indicator for the impact of green bonds. In 2020, 300 tonnes of CO2 emissions were saved for every million euros.