Globalance World Launch Speech

Discover new perspectives for your wealth.

Die Zukunft des Anlegens

Globalance World

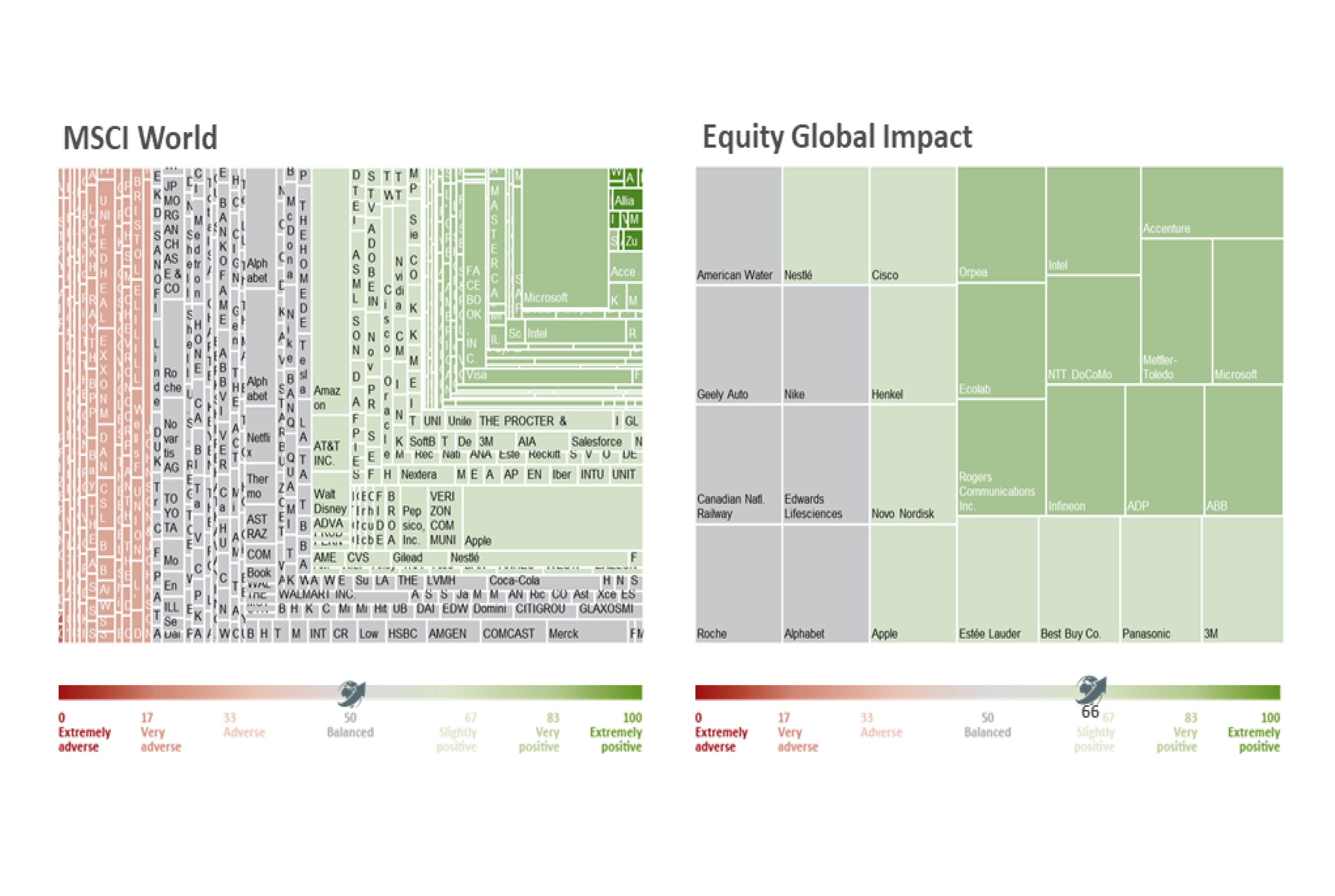

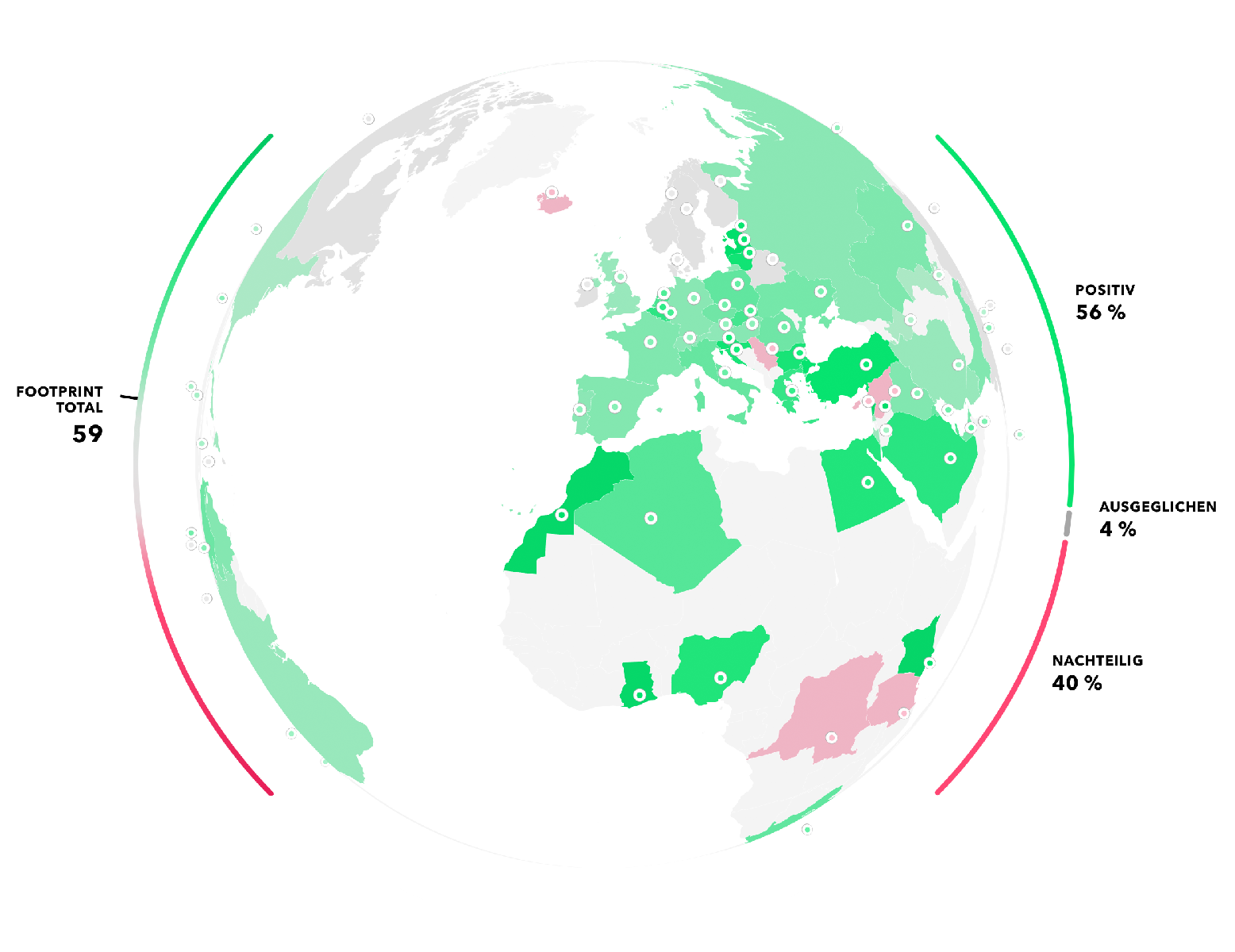

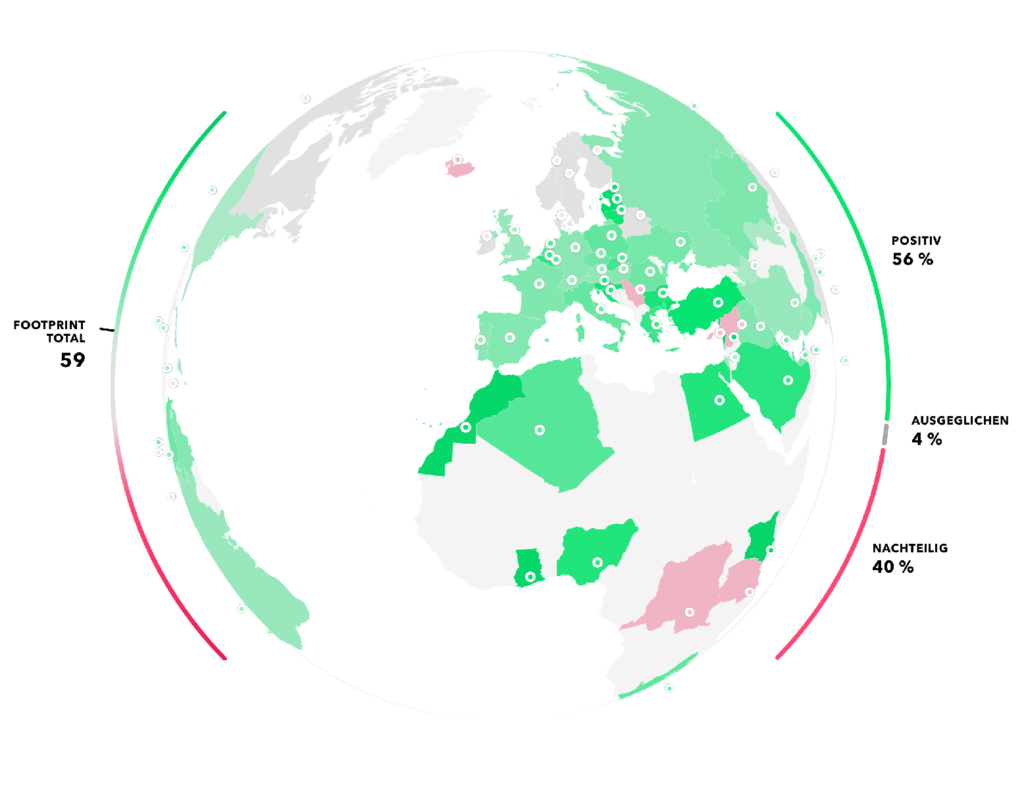

Discover Google Earth – a digital globe – for investors and see the future viability and sustainability of your investments.

The Globalance Story

We have been pioneers for over 25 years: In 1995, we founded the world’s first sustainable asset management company SAM (Sustainable Asset Management) and established the Sustainability Index with Dow Jones, thus setting a benchmark. In 2011 we founded Globalance Bank and launched Globalance World in 2020.